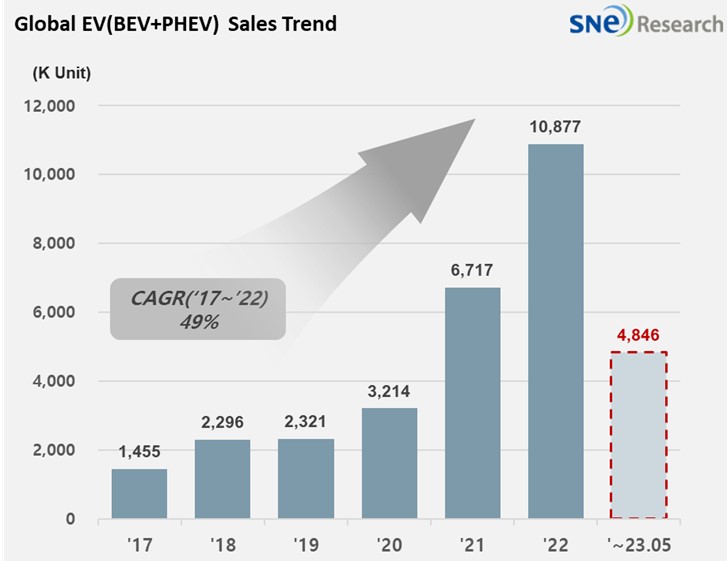

From Jan to May in 2023, Global[1] Electric Vehicle Deliveries[2] Recorded 4.846 Mil Units, a 43.0% YoY Growth

- BYD’s Global Cumulative EV Sales Record Breaking 1 Mil Units

From

Jan to May in 2023, the total number of electric vehicles registered in

countries around the world was approximately 4.846 million units, a 43.0% YoY

increase.

(Source: Global EV and Battery Monthly Tracker – June 2023, SNE Research)

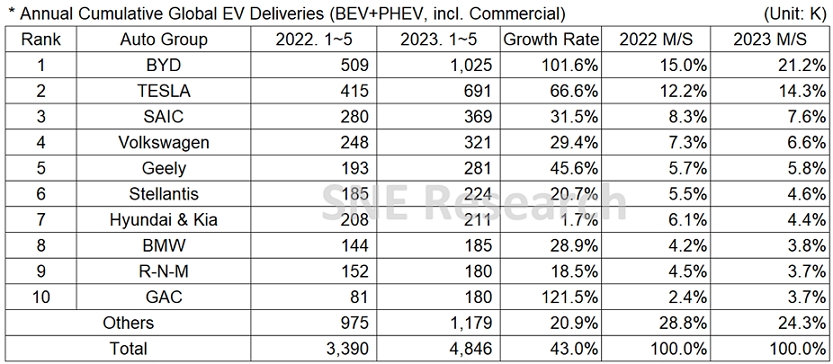

If we look at the EV sales from Jan to May in 2023, BYD, regarded as the largest EV maker in China, recorded a 101.6% YoY growth, keeping its growth momentum. In May, BYD sold more than 240k units, becoming the only EV OEM whose cumulative EV sale from Jan to May 2023 exceeds 1 million units. Tesla, ranked 2nd on the list, posted a 66.6% YoY growth, propped up with the tax credit offered to Model 3/Y under the Inflation Reduction Act as well as its price reduction strategy implemented since early 2023. SAIC, on the 3rd place, recorded a 31.5% YoY growth thanks to a favorable sale of Hongguang MINI EV, MG-4(Mulan), and MG-ZS.

(Source: Global EV and Battery Monthly Tracker – June 2023, SNE Research)

Hyundai-KIA Group recorded a 1.7% YoY growth, led by IONIQ 5, EV6, and Niro. With the launch of KONA (SX2) Electric and EV9 as well as the global sale of IONIQ 6, the group is expected to see a rebound in the global green car market and possibly continue to break its record in profit even in the 2nd quarter’s earnings announcement.

(Source: Global EV and Battery Monthly Tracker – June 2023, SNE Research)

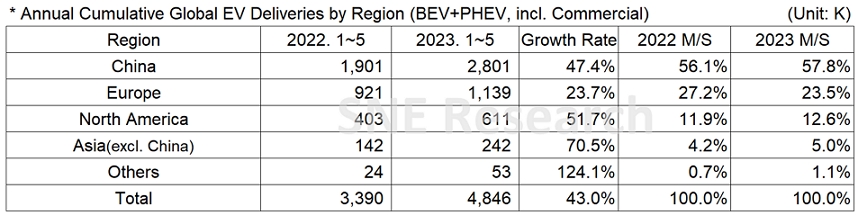

The EV market in China went through a temporary slowdown earlier this year as demand for EV was disproportionately concentrated in last December due to the news on subsidy termination by the Chinese government. However, since then, the market has continued to be in an upward trajectory. Many of Chinese startups, who mostly focused on making vehicles to meet the subsidy requirements, were found to be less qualified in terms of vehicle design and performance. After the subsidy termination, customers have turned their back to those startup companies. Moreover, due to a fierce competition, many of Chinese EV startups lost their price competitiveness and eventually, lost their places to stand in the market. With the Chinese government showing a strong will to increase the EV penetration by extending the tax credit offered to owners of new EVs till 2027, the Chinese EV market is forecasted to expand and integrated by major players such as BYD and Tesla.

[2] Based on electric vehicles (BEV+PHEV) delivered to customers or registered during the relevant period